Asking for customers’ tax ID at checkout

You can allow customers to provide their tax IDs at checkout. For example, if you’re required to collect specific tax information in your country by law, or if you want to use tax IDs provided by customers to issue invoices — in your online store or in the outside invoicing software of your choice.

To ask for customers’ tax ID at checkout:

- From your store admin, go to Settings → Taxes & Invoices.

- Scroll down to Settings.

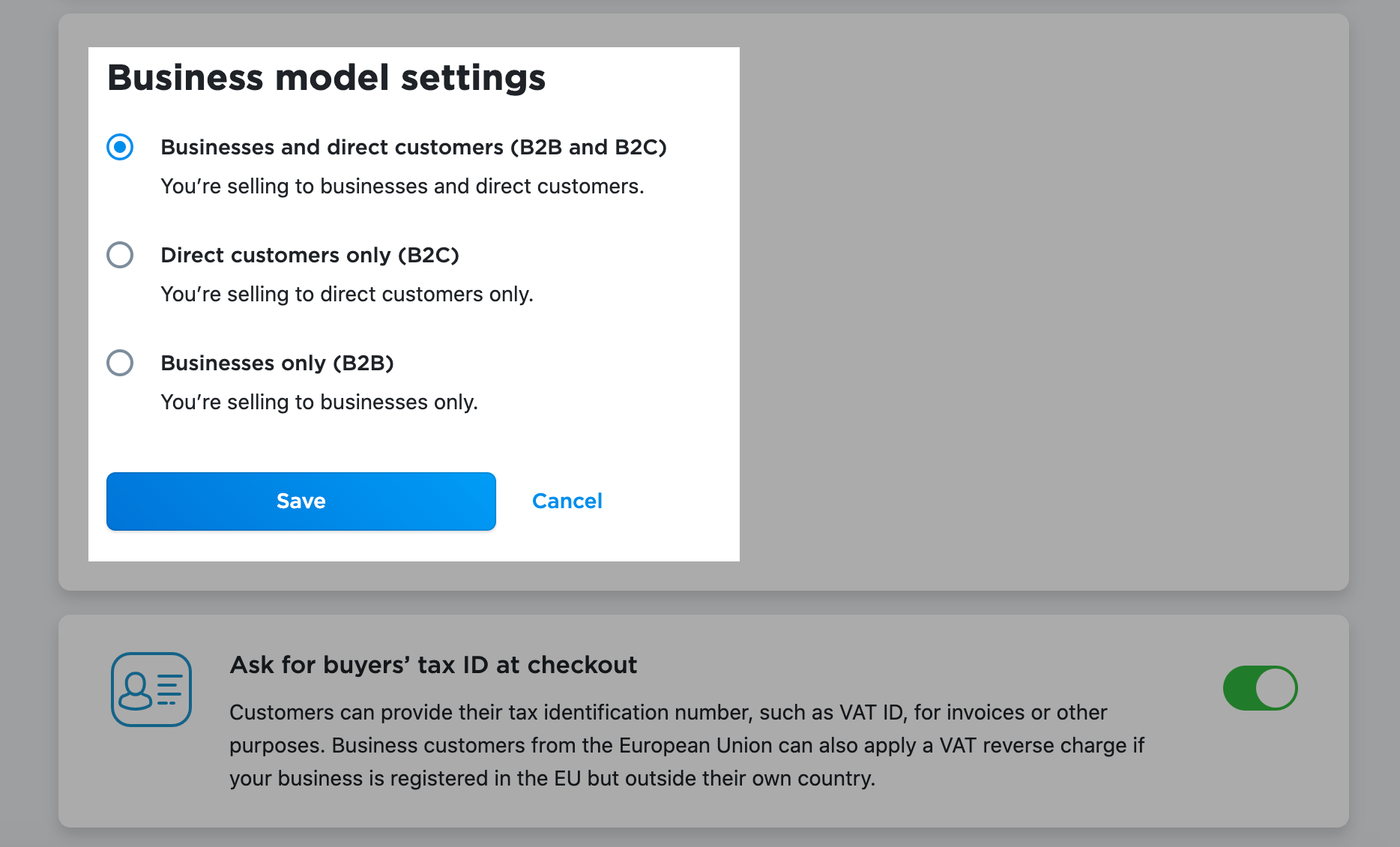

- In the business model settings block, specify who your customers are: Businesses and direct customers (B2B and B2C), Direct customers only (B2C), or Businesses only (B2B):

- Click Save.

- Enable the Ask for buyers’ tax ID at checkout toggle below.

- The changes will be saved automatically.

That’s it! Now your customers can provide their tax IDs when placing an order.

The tax information block can contain one or several fields. The look of the block depends on:

- The country where your store is based (you specify it on the Store Profile page in your store admin)

- The country of your customer

- Whether your customer is B2B or B2C

This is how the tax information block may look at checkout:

Tax Information provided by customers will be saved in the order details in My Sales → Orders for your future reference. You can export it if you need.

Related articles:

Asking for customers’ Codice Fiscale/Partita Iva/SDI info

Asking for customers’ IČO/DIČ numbers

Asking for customers’ CPF/CNPJ numbers

Asking for customers’ tax ID in the EU

Creating tax invoices